EastFruit analysts have observed a decline in the export conditions for these commodities from Uzbekistan. Effective May 14, 2024, the nation's Cabinet of Ministers has mandated that previously suggested prices for fruits and vegetables, accessible via a designated link, now serve as the minimum allowable prices.

Consequently, the export of fruits and vegetables at prices below those determined by government officials, reflecting their market assessment, is now forbidden. Notably, these prices are fixed for the produce irrespective of quality, variety, or other differentiating factors, which disregards the inherent diversity within the fruit and vegetable industry.

Historical trends indicate that such regulatory decisions are detrimental across the board. They primarily affect producers and small-scale exporters by limiting their market opportunities. This restriction not only diminishes investment appeal in agricultural production but also detracts from Uzbekistan's attractiveness as a trading partner for major, established importers. The introduction of such direct controls makes the prospect of long-term contractual partnerships exceedingly precarious.

Moreover, in terms of enhancing tax revenue and improving currency regulation, this policy is deemed ineffective. While large corporations can easily navigate around these minimum price constraints using sophisticated financial tools, the overall tax base is likely to contract.

It has been previously reported that Uzbekistan is phasing out one of its most robust export categories within the horticultural sector – greenhouse vegetables.

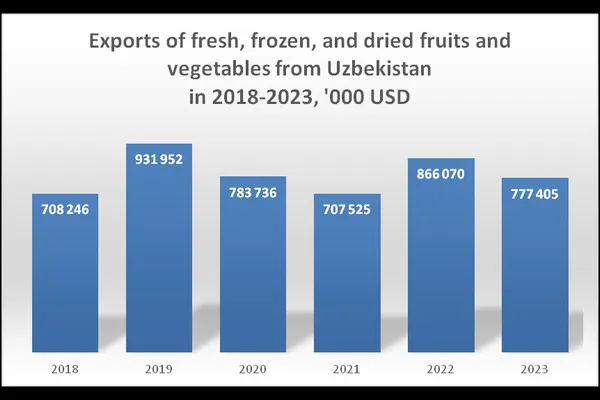

Furthermore, Uzbekistan's export performance in the fruit and vegetable sector has not demonstrated significant growth. The country's export earnings in 2023 experienced a 10% decrease, amounting to $777 million USD. However, official reports present an inflated figure by incorporating dry legumes into the fruit and vegetable export statistics, which, for a precise analysis, should be categorized under grain legume exports due to their distinct trade characteristics.

In summary, despite the favorable conditions for export expansion—especially since Russia has imposed import restrictions on fruits and vegetables from the majority of the world—Uzbekistan's export figures have remained stagnant. Over the past five years, export values have oscillated between $700 and $900 million USD.

While the proportion of dried fruits within the export mix is on the rise, global demand and prices for these products are on a downward trend. In contrast, the market share for fresh produce is experiencing a decline.

Source: east-fruit.com